Car Tax Reduction Malaysia

You can get a 50 reduction in vehicle tax if you get the. But most electric vehicles wont qualify for the credit with the Alliance of Automotive Innovation estimating about 50 out of the 72 hybrid or plug-in models wont meet the requirements.

Should You Buy A Commercial Vehicle Tax Savings Calculation

With the sales tax exemption Volkswagen buyers can expect savings ranging from RM930 for a locally-assembled Polo 16 MPI Comfortline right up to RM9484 for a fully-imported Golf R Mk75.

. 40 of the QPE incurred. Rear Drawer Construction and Operating Guidelines Amendment 12015 VTA Application Procedure. First James is required to file in income tax for company car benefit under Section 13 1 b of the Income Tax Act ITA 1967.

It is viewed as employment income to James because it is a company car benefit provided by P-Tech his company for his continuous employment. In his case the company car benefit James needs to file in. Roadtax reduction according to vehicles age.

The price increase is because Malaysia uses an outdated tax system. For the first time you can get a tax credit for used EVs. Only in Malaysia car prices going higher and higher.

ADP standard rate mobility component. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under. Annual car Roadtax price in Malaysia is calculated based on the components below.

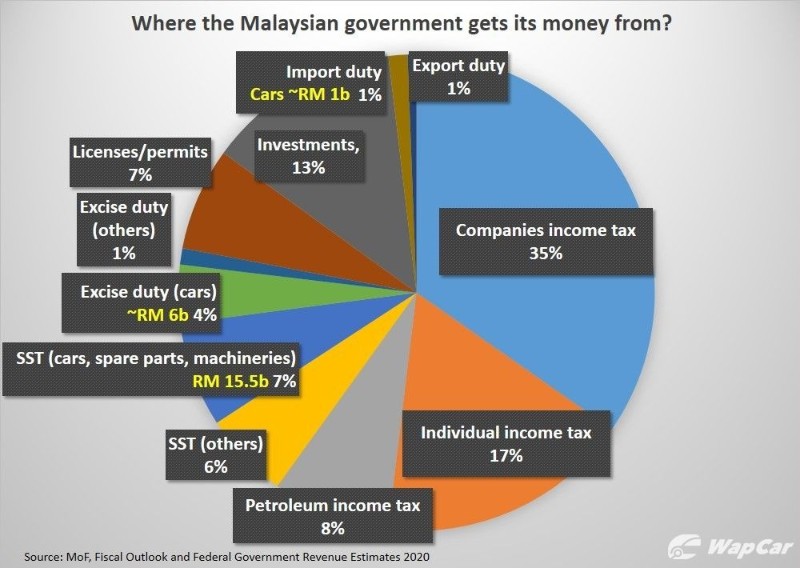

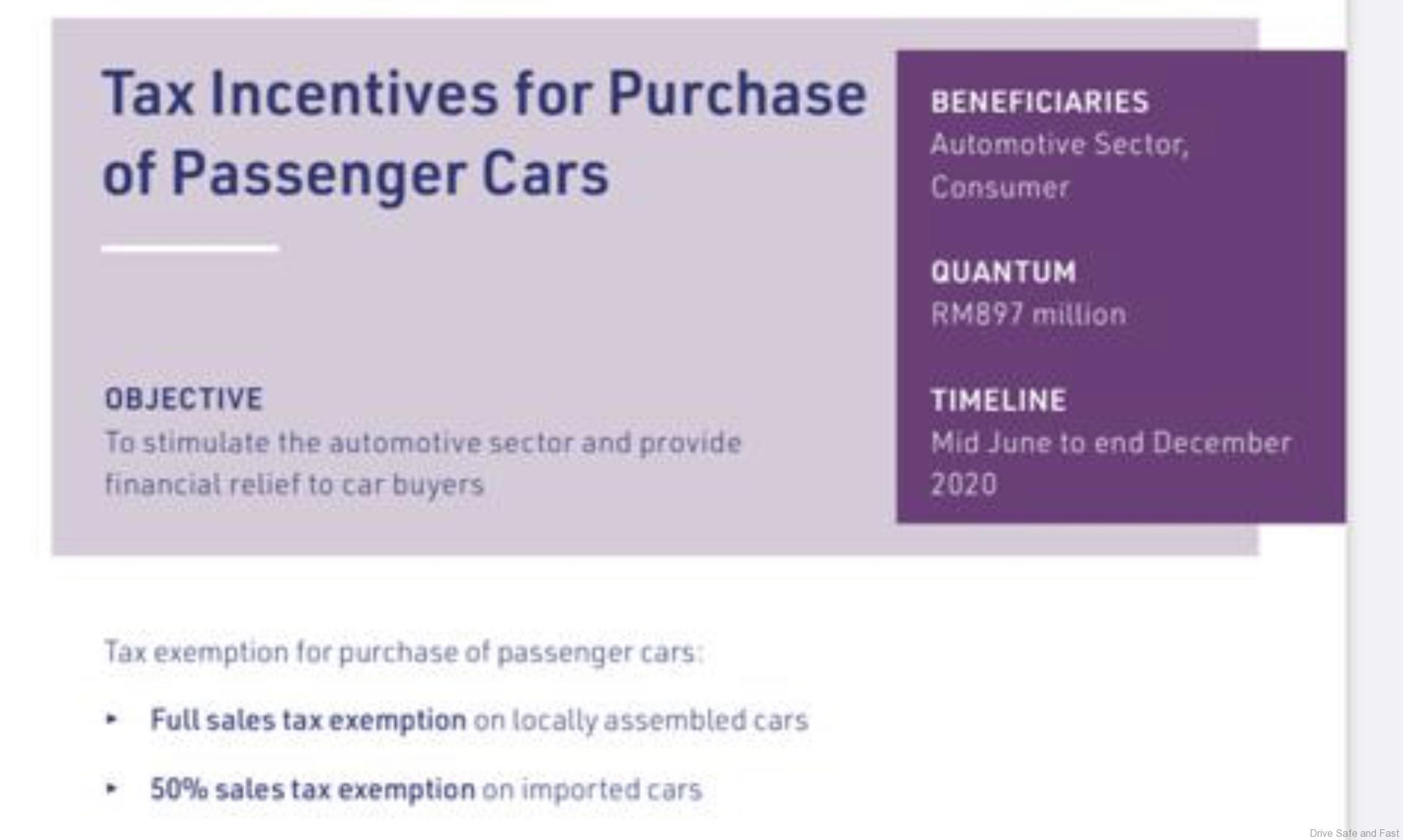

Guidelines on Application for Vehicle Panel Structure Repair or Conversion Accident Cases Application for Beacon Light Installation. Sales Tax 1500 30 0 NIL 0 60 10 1500 - 1799 30 0 NIL 0 65 10 1800 - 1999 30 0 10 0 75 10 2000 2499 30 0 10 0 90 10 Above 2500 30 0 10 0 105 10 Class MFN ATIGA MFN ATIGA Excise Duties Sales Tax All 30 0 NIL 0 NIL 10 Notes. This sales tax exemption on purchases of new vehicles was previously granted from 15th June 2020 until 31st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when.

In our current roadtax calculation assumption is taken that bigger enginesdisplacement emits more pollution. The sales tax exemption for passenger cars including multi-purpose vehicles MPVs and sport utility vehicles SUVswill be extended until June 30 next year the Ministry of Finance. Increment and Reduction in income tax.

The Inflation Reduction Act claims that by investing 80 billion over the next ten years for tax enforcement and compliance the IRS will collect 203. Vehicle price requirements. To reduce the cost of vehicle ownership the Government will extend the 100 sales tax exemption on CKD locally assembled passenger vehicles and 50 on CBUs imported including MPVs and SUVs.

All over the world car prices are going down. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars. Engine displacement Cubic Capacity Liter.

Classic car You can enjoy up to an 80 reduction in annual roadtax if your car qualifies as a classic car after reaching 25 years old. The Ministry has also set up a special body named. Under the Rules QPE refers to a capital expenditure incurred under paragraph 2 of Schedule 3 to the Income Tax Act 1965 ITA in relation to provision of machinery and equipment including ICT Equipment except motor vehicle.

PIP standard rate mobility component. Individuals dont qualify for the tax break if their van sport utility vehicle or pickup truck costs more than 80000. According to the memo the percentage of sales tax exemption remains unchanged from what was announced before with 100 for locally-assembled CKD cars and 50 for fully-imported CBU cars.

MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement. Bigger engines pays more tax. 20 of the QPE incurred.

Implementation of the World Forum for Harmonization of Vehicle Regulations WP29 Framework in Malaysia. The Inflation Reduction Act passed the Senate on Sunday with provisions to provide an up to 7500 tax credit to electric vehicle buyers. Vintage car You can get up to a 90 reduction in annual roadtax if your car qualifies as a vintage car after reaching 50 years old.

The Inflation Reduction Act also includes a tax break for people who purchase a. KUALA LUMPUR April 22 The government has always encouraged the use of vehicles using green technology by promoting various initiatives including a 50 per cent reduction in road tax for electric and plug-in hybrid vehicles Deputy Transport Minister Datuk Kamaruddin Jaffar said. Toyota Corolla Altis in Malaysia in 1988 was RM20k Toyota Corolla Altis in Malaysia in 2020.

The vehicle should be registered in.

Up To 34 Reduction In Road Tax For Electric Cars Ong Ye Kung

Budget 2022 Evs Fully Tax Free And Sales Tax Exemption Extended To June 2022 Autobuzz My

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Sales Tax Exemption For Ckd 100 And Cbu Cars 50

Cars Up To 1600cc Likely To Be More Affordable For Middle Class

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Comments

Post a Comment